Why a Life Insurance Policy Review is Crucial - A Case Study

How Can Life Insurance Policy Reviews Help You?

I recently reviewed a life insurance policy for a 72-year-old client.

What I found shocked me—her expected $79,000 in cash value was actually zero unless she surrendered her policy.

Let me explain why reviewing your policy regularly is critical.

This blog is the written version of a YouTube video by Frank Biaggi, CEO of Biaggi Life.

Hi, I'm Frank Biaggi, CEO of Biaggi Life, and we're going to talk about why reviewing your life insurance policy is so important.

I'll walk you through a real-life case study of a client I worked with.

The Client’s Case: A Risky Life Insurance Policy

I had a 72-year-old female client who owned multiple life insurance policies—some I had written as far back as 20–25 years ago, and others set up by a different agent.

While reviewing the policies I had set up, her husband asked me to take a look at the ones from the other agent.

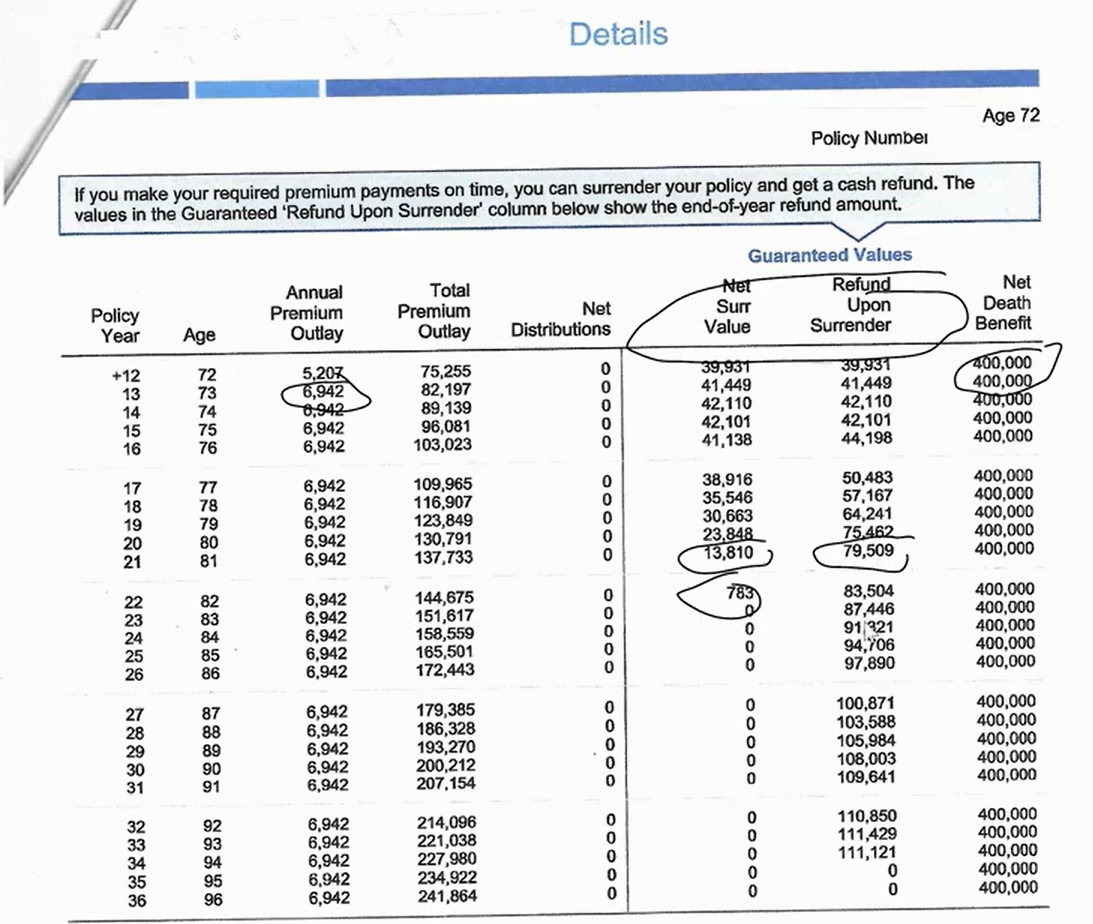

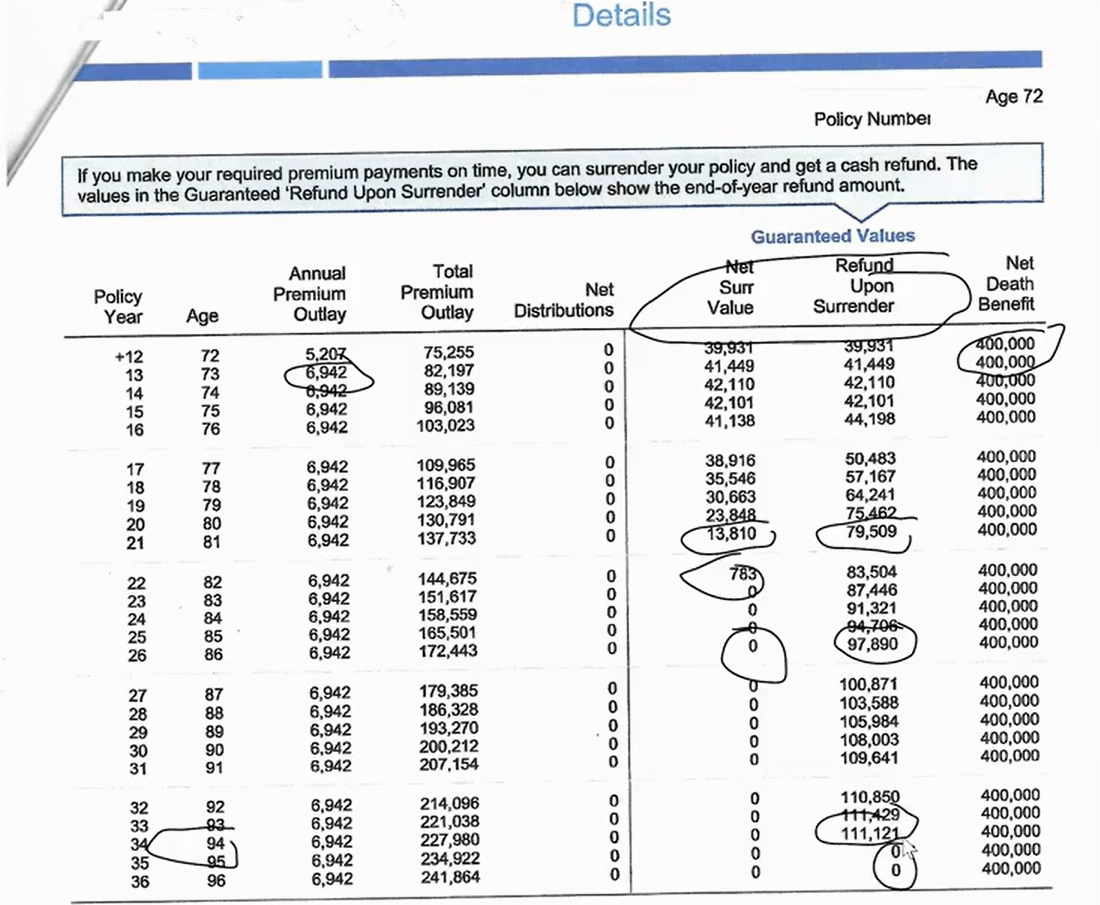

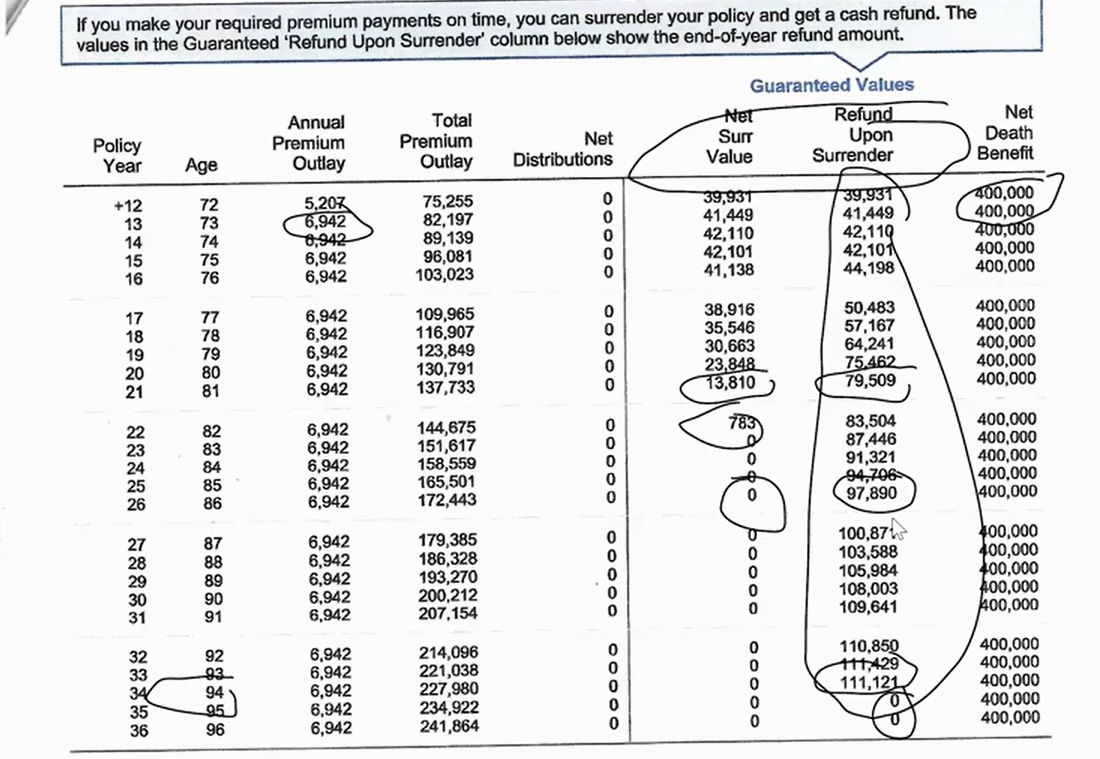

One of these policies stood out. It was a $400,000 policy with an annual premium of $7,000.

At first glance, the numbers looked promising. The cash value column showed $79,000 in 10 years, while another column displayed no value at all until the 12th year.

Then, I looked a little bit further...

A Shocking Discovery

As I examined the policy more closely, I noticed something unusual.

The cash value increased for several years but suddenly dropped to zero at age 94. That was odd.

Typically, cash value gradually decreases, but this policy showed an abrupt drop.

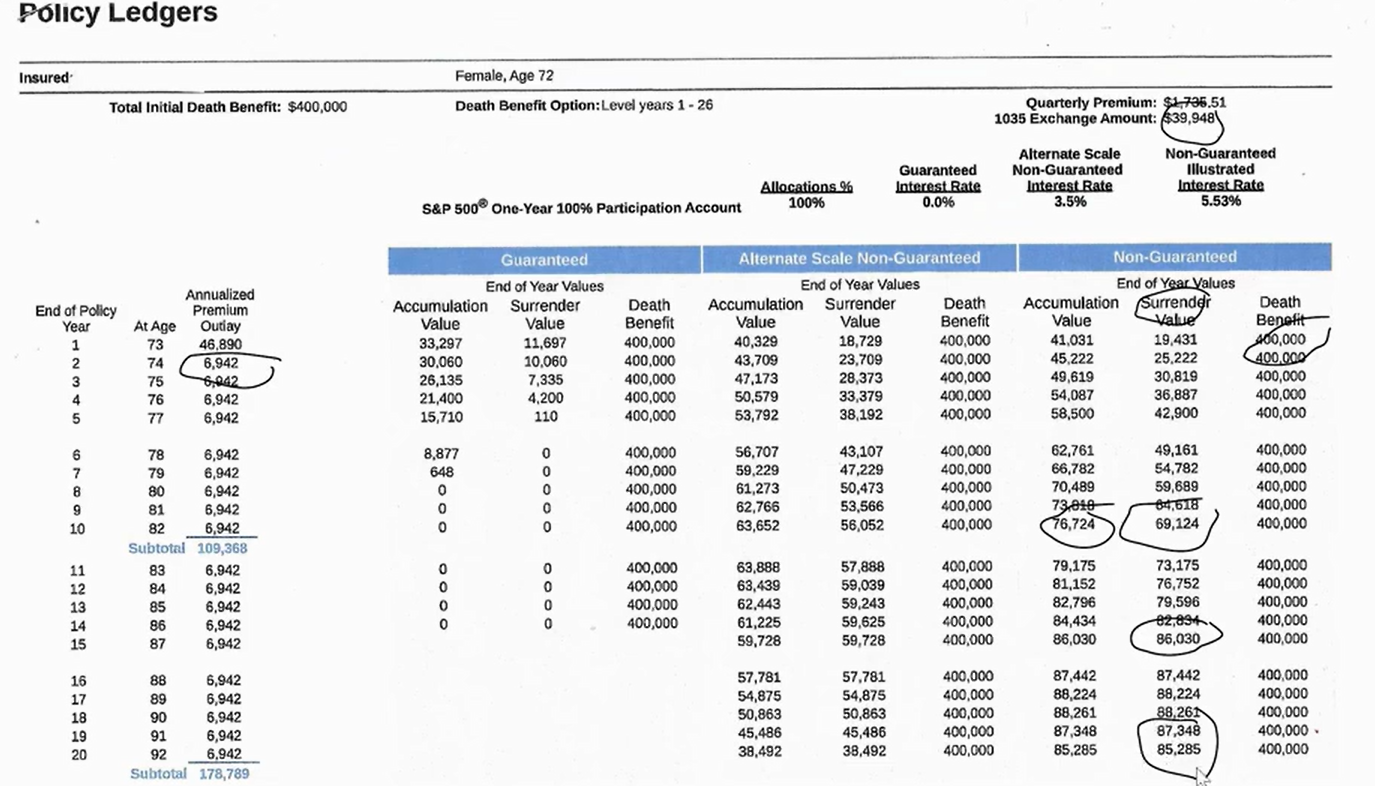

When comparing it to a more traditional policy, I saw that by age 92, her cash value should have been around $85,000 before slowly decreasing.

But this policy simply zeroed out—something I had never seen before in decades of working with life insurance.

What Was Really Happening?

Digging deeper, I found the problem: this was not cash value at all.

Instead, the column showing $79,000 in 10 years was labeled “refund upon surrender.”

This meant the only way to access that money was to cancel the policy entirely.

True cash value allows policyholders to borrow or withdraw money while keeping their policy intact.

But in this case, if my client ever needed funds, she’d have to surrender the policy, losing her $400,000 death benefit.

Even worse, the actual cash value in 10 years was only $13,000—and within two more years, it dropped to zero. That meant all of her cash value would disappear.

She had been led to believe she had nearly $80,000 available, but in reality, she would have had nothing.

How We Fixed the Problem

Luckily, my client was still healthy and had already qualified for new coverage. We used a 1035 exchange, which allowed her to transfer her policy to one that protected her cash value.

Her new policy:

- kept her $400,000 death benefit

- allowed her to access true cash value

- did not require a permanent disability to qualify for nursing home benefits

With this switch, she avoided losing all her cash value and secured a much better policy.

The Lesson: Always Review Your Life Insurance Policy

If she hadn’t reviewed her policy, she would have lost everything—her expected $90,000 in cash value, her ability to pay premiums, and eventually her entire life insurance policy.

The only way to prevent this from happening?

- Annual reviews. Every single year, check your policies.

- Ask questions. Don't assume numbers mean what you think they mean.

- Work with a professional. Someone who knows what to look for can save you from costly mistakes.

I hope this case study helps you understand the importance of reviewing your life insurance policy regularly.

Don't leave your life insurance to chance. At Biaggi Life, we put your best interests first, just like we did for this client.

If you want expert guidance from someone who truly looks out for you,

book a virtual meeting today and take control of your financial future.