College Funding with Life Insurance - Why It Works

College Funding Strategies with Life Insurance

Paying for college with a life insurance policy?

Sounds simple, just buy a policy and start paying into it, right?

Not exactly.

There’s more to it than that. To actually make this strategy work, you need the

right kind of policy, with the right structure,

benefits, and

flexibility.

Let me show you

what to look for, so you can build real

savings for

college and make sure your policy works for you from start to finish.

This blog is the written version of a YouTube video by Frank Biaggi, CEO of Biaggi Life, with agency development partner, Kimberly Tran.

Hi, I'm Frank Biaggi, CEO of Biaggi Life.

Today, with our agency development partner, Kimberly Tran, we're going to talk about using a life insurance policy for college funding.

We want to show you exactly a template of what you want to look at in the policy so you make sure you get the right policy that you can use to fund it and that works for you all the way through.

Start with the Right Policy

If you're planning to use life insurance for college funding, the policy you choose matters.

You'll want a competitive one that builds strong cash value, so you have money available when tuition bills start rolling in.

So, the first thing you want to do, is get a policy that has a very low minimum premium.

Let me show you what I am talking about.

Real Example: Low Premium, High Value

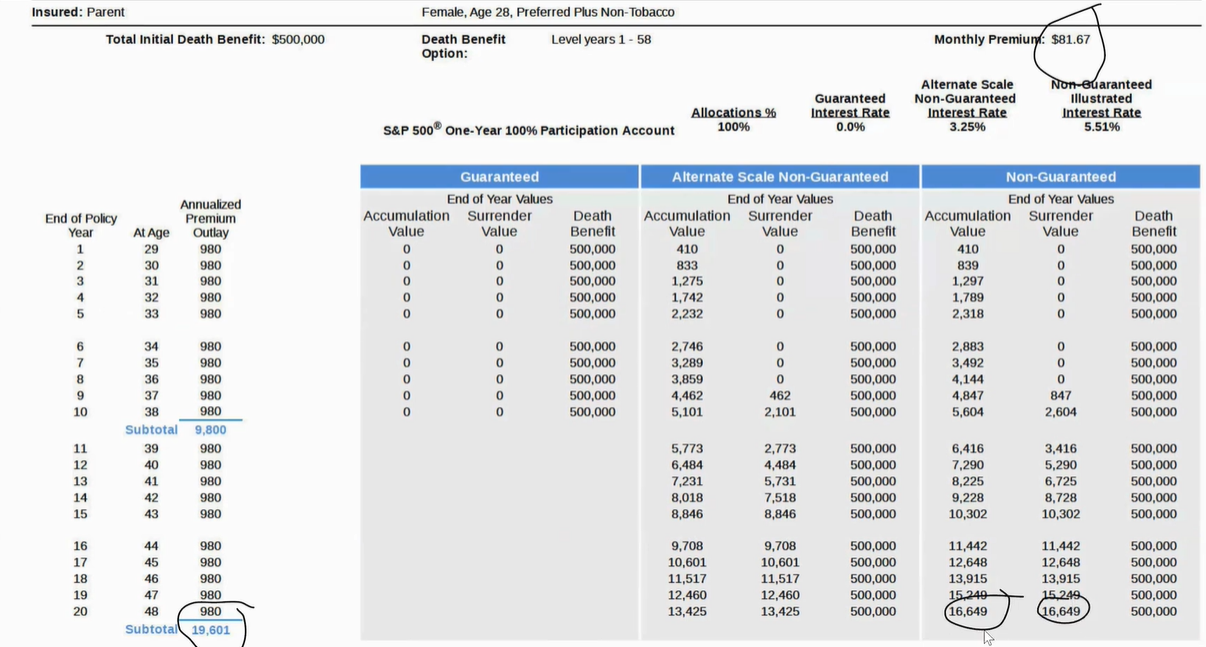

This is a policy for a healthy 28-year old woman. The minimum premium is only $81.67/month.

Now, look at what happens after 20 years:

- She’s paid in about $19,601

- Her cash value is around $16,649

- That’s a net cost of only $12 a month

This is cheaper than most term policies. Plus, it builds real value you can use for college or anything else.

Then…

Why People Don’t Use This Instead of Term

If we can get something as low as this; permanent and so flexible, “Why don’t people use this instead of term insurance?”

Honestly, I ask myself the same thing.

A lot of agents still push term policies even though the net cost is often higher in the long run.

It depends on what the agent is showing you, and what they have access to. There are a lot of companies out there. I’m just showing you a really competitive policy that has a real low premium.

If you were looking at a policy that an agent was showing you that had a real high premium—like an old whole life policy—then I could see buying a term policy.

But with this particular policy, it has all that flexibility. So again, it wouldn’t make any sense to me to buy term over this, because the net cost is only about $12 a month.

Comparison with Term Premium

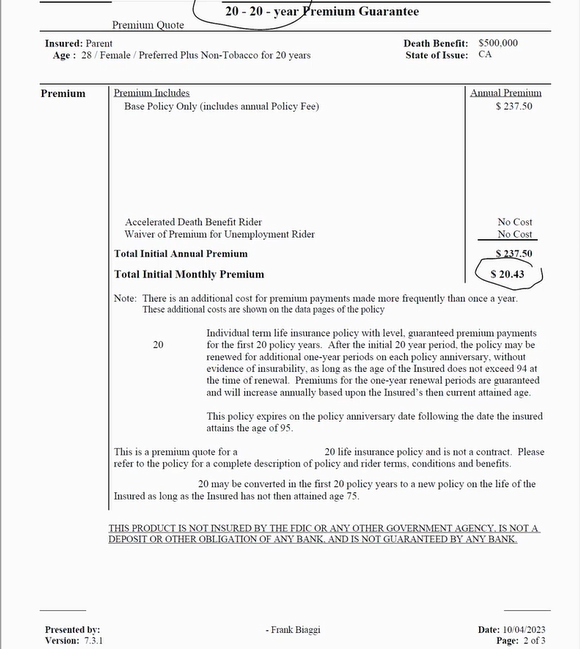

“If I had purchased a term policy, what would the premium be in comparison to the policy that you’re demonstrating?”

Here’s a 20-year term policy. The monthly premium is just $20.43.

But after 20 years?

- You’ve paid for it the whole time

- The policy ends

- You walk away with nothing

Some of these have a conversion option, but by then, it’ll cost more. You’ll be older. Maybe your health has changed. That means higher premiums—or no coverage at all.

Now go back to the first example. That $81/month policy gives you:

- Lifetime coverage, you can keep going as long as you like

- Almost $17,000 in cash value

- Flexibility to adjust contributions

- A net cost of just $12/month

- $500,000 death benefit until the age of 86—keep it going as long as you want

It’s a no-brainer. For a few extra bucks each month, you keep your policy for life and build real value.

Now, the second thing that is very important—is you want to know what the premium is going to be to guarantee that policy where the company can’t raise the rates.

That’s called a no-lapse premium.

What Is a No-Lapse Premium?

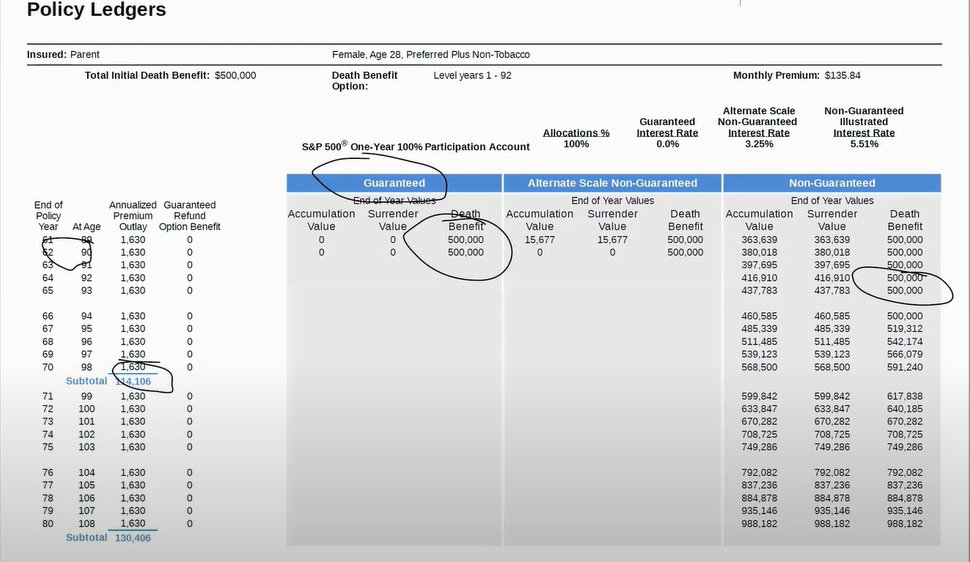

Let’s say you love that minimum premium—$81/month—but want more security. You don’t want the insurance company to raise rates or cancel your policy later. That’s where the no-lapse premium comes in.

It’s a guaranteed amount you pay monthly to lock in your coverage.

In this case, the no-lapse premium is $135.84/month.

Here’s what that gives you:

- Coverage guaranteed through age 90

- A $500,000 death benefit

- Only about $100,000 paid in total

- No rate increases—ever

At age 90, you still have coverage. And you can go beyond that if you want. Just bump up your payment a bit to extend it past 90. As long as the cash value stays positive, your policy won’t expire.

So what happens if my policy didn’t have a no-lapse premium?

If you don’t have a no-lapse premium, what happens is:

- They can raise the rates

- They will discontinue a product, come out with new ones

- They can go to the Department of Insurance and justify raising the rates

If you have a good policy like this, with a real low premium, you want that guarantee to keep your policy safe—so you don’t have to worry 20, 30, 40 years down the road if the company’s going to raise the rates and you could potentially lose your policy.

How Much Can You Contribute? (TAMRA Rules)

Once you understand the minimum and no-lapse premiums, the next question is:

What’s the maximum amount of money you can put into it?

So we already know:

- Minimum premium = $82/month

- No-lapse premium = $135.84/month

There are limits on how much money you can fund into life insurance because of tax advantages.

Back in the day, people were dumping hundreds of thousands into life insurance to grow money tax-free.

The government stepped in and said, “Hold on. You can’t do that.”

So, they passed a rule called TAMRA—short for the Technical and Miscellaneous Revenue Act.

Under TAMRA, there’s a cap on how much you can contribute each year without losing the policy’s tax benefits.

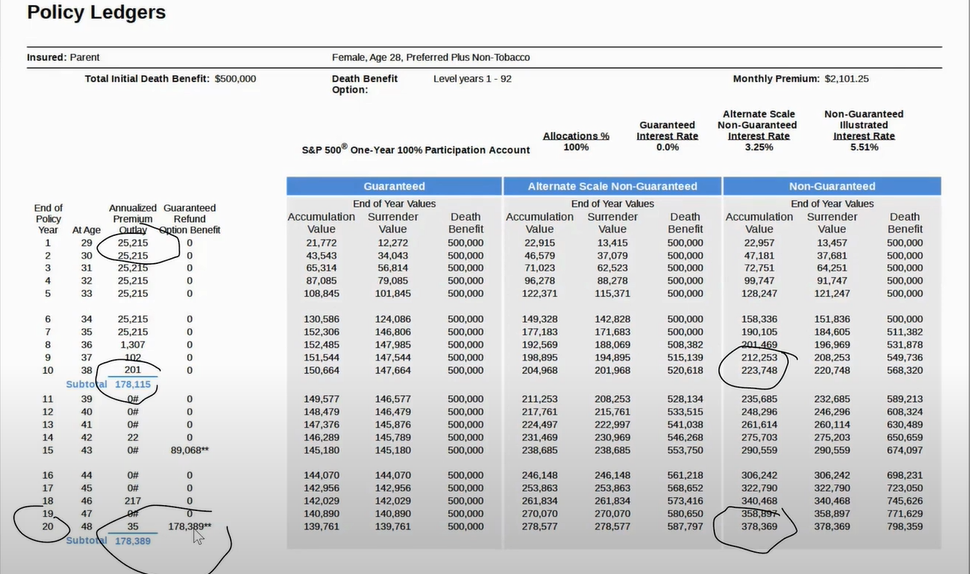

In the example policy:

- TAMRA limit = $25,000/year

- You can fund that amount for 8 years, then a little more in years 9 and 10

- Total contribution = $178,115

- Accumulation value by year 10 = $223,748

That’s the maximum you can put in without the policy losing its life insurance classification.

If you exceed the maximum, you will lose the tax advantages.

How TAMRA Rules Protect Your Policy and Improve It

As long as you stay within the TAMRA limits, all the money inside your policy grows tax-deferred, and you’re protected by tax law.

Let’s say you fund your policy with $178,000 over 10 years.

If that grows to $223,000, you can take out the first $178,000 tax-free.

That’s because of something called FIFO—First In, First Out.

It means the money you put in (your premiums) comes out first. And since you used after-tax dollars, there's no tax on withdrawals up to that amount.

Why TAMRA Changed the Game (In a Good Way)

Years ago, people were putting huge sums of money into life insurance policies—millions in some cases—just to avoid taxes.

The government stepped in, passed the TAMRA law to cap how much you could put in while still calling it “life insurance.”

But here’s the good news: you can still contribute up to $25,000 per year. That’s more than enough to build solid cash value over time.

And honestly? I think these limits actually made policies better.

Why?

Because insurance companies had to adjust.

They trimmed internal fees, improved how the cash value grows, and created more competitive policies—especially for people using them to fund things like college education.

Final Thoughts

A well-structured life insurance policy can do more than just protect your family—it can help you build real, tax-advantaged savings for college.

With the right plan, you get:

- Affordable premiums

- Lifetime coverage

- Tax-free withdrawals

- Strong cash value growth

- Flexibility you won’t find in term policies

If you’re thinking about using life insurance for college planning, now is the best time to get started.

At Biaggi Life, we make sure your life insurance truly works for you.

With decades of experience, I’ll help you secure the right coverage.

If you want an expert to review your policy and protect your best interests, book a virtual meeting today.