Should Young Adults Buy Life Insurance?

Should Young Adults Buy Life Insurance?

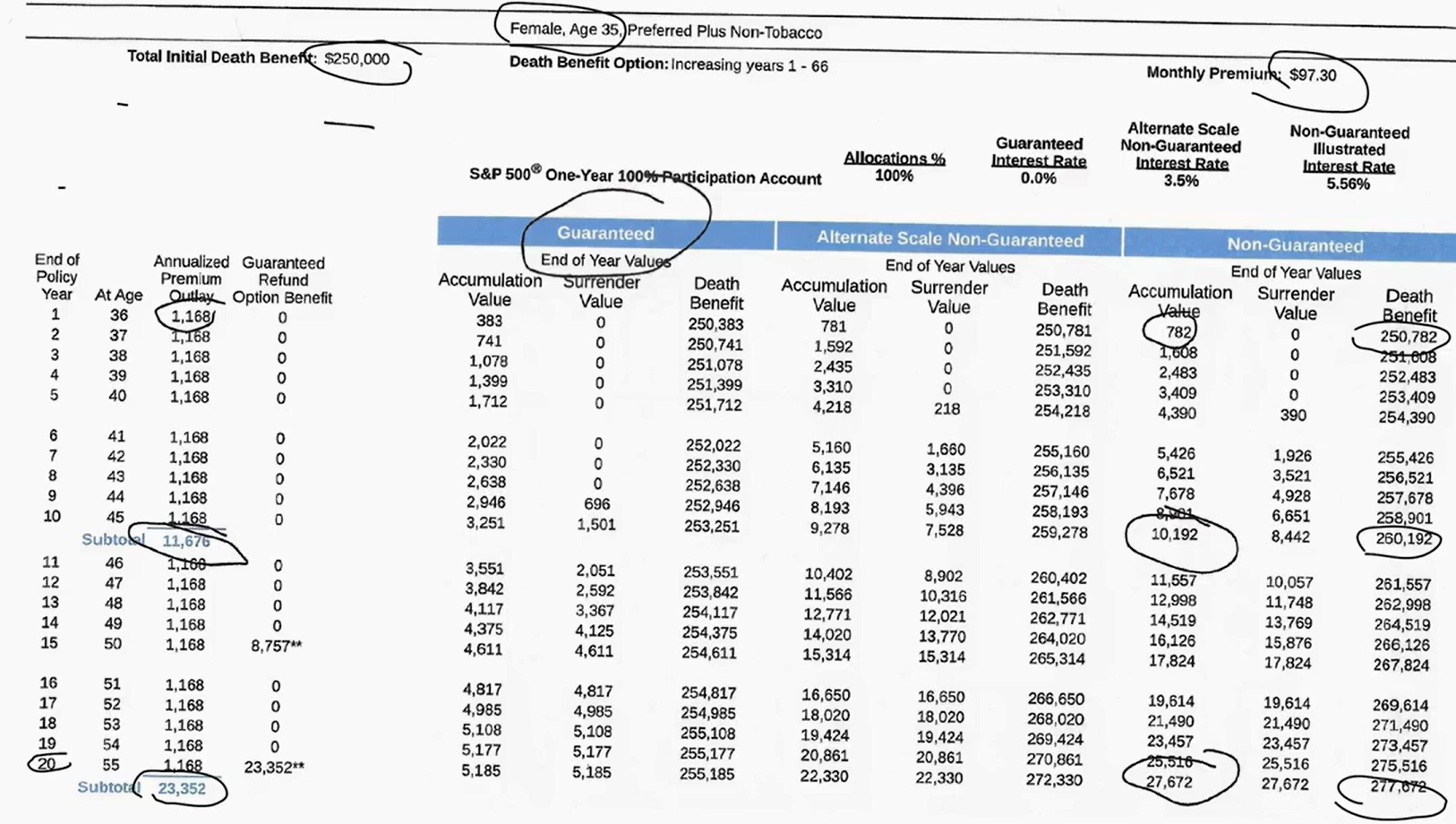

I recently designed a life insurance plan for a 35-year-old woman.

What makes it different? For just $97.30 a month, she’s not only getting $250,000 in coverage—her policy is also building cash value she can access tax-free.

By age 65, she’ll have paid $35,028, but her death benefit will have grown to $304,023—all while keeping lifelong coverage.

Let me show you why locking in a policy early can be a game-changer for your future.

This blog is the written version of a YouTube video by Frank Biaggi, CEO of Biaggi Life.

Hi, I'm Frank Biaggi, CEO of Biaggi Life.

Today, I want to talk about life insurance for young adults.

If you’re in your 20s or 30s, you may have thought about getting life insurance but felt it was too expensive or unnecessary.

To address this, I’ve put together a program that provides significant value for young adults looking into life insurance.

Case Study: A 35-Year-Old Female Considering Life Insurance

Let’s take a look at an example. This is a 35-year-old woman who is single and contemplating life insurance.

She has questions like, “Why would I want to buy a policy?”

For a $250,000 policy, her monthly premium is only $97.30. Here’s how the numbers work out:

- In year 1, her policy builds $782 in cash value, which is added to the death benefit.

- By year 10, she has paid $11,676 and has a cash value of $10,192. That’s nearly all the premiums she’s put in.

- By year 20, she has paid $23,352, and her cash value has grown to $27,672.

At age 65, she would have paid $35,028, and her death benefit would be $304,023.

Indexed Universal Life vs. "Buy Term and Invest the Difference"

Many people consider buying term life insurance and investing the difference instead of choosing a permanent policy. But here’s the key difference:

- With Indexed Universal Life (IUL), your coverage never ends as long as there’s enough cash value.

- With term life insurance, your policy expires after 30 years, and you’re left with zero coverage.

At age 65, both approaches may result in around $54,023 in savings. However:

- With IUL, you still have a growing death benefit and active coverage.

- With term life, your policy has ended, and you’d need to buy a new one—at a much higher rate due to your age.

Even if your term policy offers a conversion option, it would convert into a new policy at your then age, making it much more expensive.

By locking in an Indexed Universal Life policy early, you secure:

- Lifelong coverage

- Steady cash value growth

- Lower, locked-in premiums

This is why IUL is a game-changer compared to the traditional “buy term and invest the difference” strategy.

How to Build More Wealth with Indexed Universal Life

Some people ask, Can I put more money into my policy to grow my cash value faster? The answer is

yes.

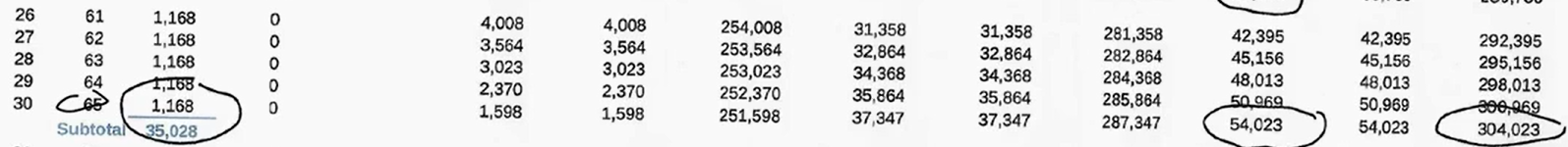

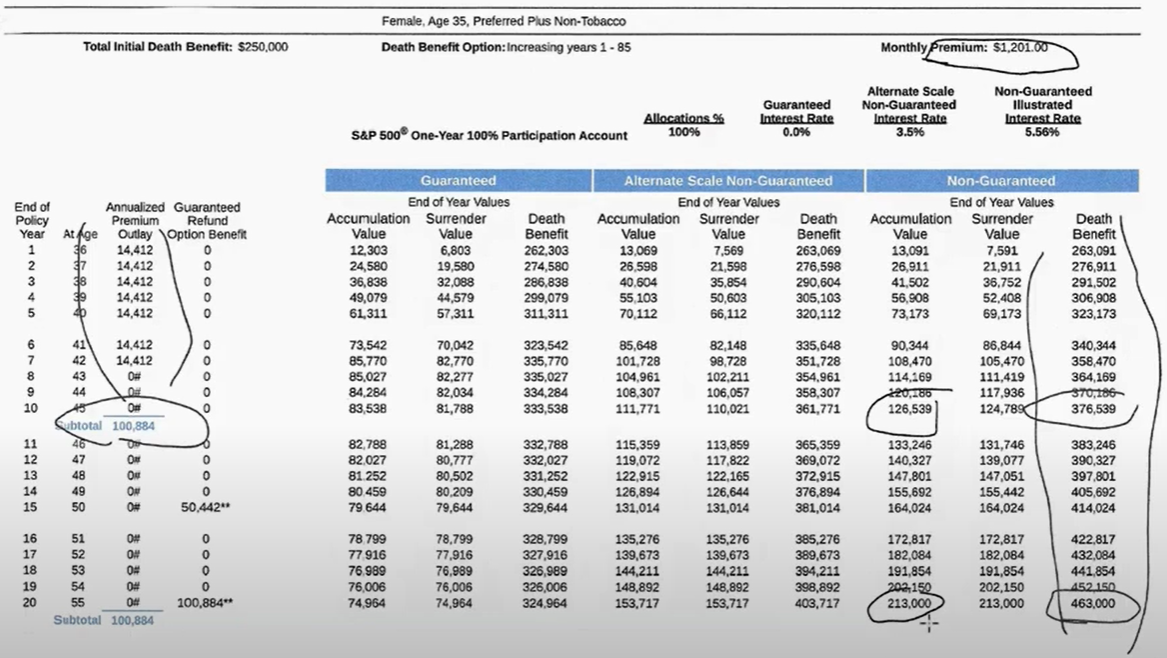

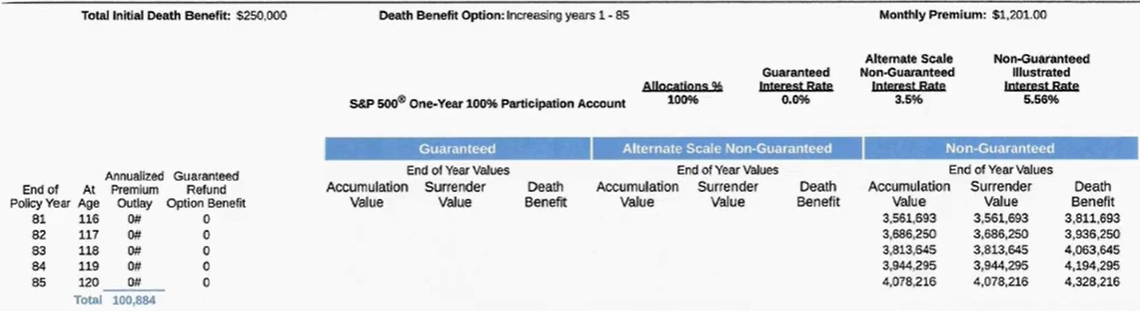

You can increase your premium up to $1,201 per month ($14,412 per year). If you do this for seven years, your policy becomes fully funded, meaning you can’t add more money while keeping it tax-qualified.

Here’s how your numbers would look:

- Year 10: You’ve paid in $100,000, and your cash value is $126,000. Your death benefit is $376,539.

- Year 20: You’ve still only paid $100,000, but your cash value has grown to $213,000.

- Age 65: Your cash value reaches $357,854, and your death benefit is $607,854.

- Age 120: Your cash value and death benefit each reach $4 million.

Since this is a life insurance policy, you can withdraw your first $100,000 tax-free under the FIFO (First In, First Out) rule. After that, you can access more cash as a loan—also tax-free as long as your policy stays active.

With a term life policy and separate investments, you can’t do this. That’s why this Indexed Universal Life (IUL) policy is so valuable—it gives you lifelong coverage and tax-free savings in one plan.

Flexible Premium Payments

Another big advantage of this policy is flexibility.

- The minimum premium is $657 per year ($55 per month).

- You can adjust your payments anywhere between $55 and $1,200 per month based on what you can afford.

This means you can start small and increase your payments later while keeping your original age and health rating locked in for life.

If you had to reapply for a new policy later, you’d be older, and your rates would be higher. But with IUL, your rate stays based on your original age—no matter what happens to your health.

Why Indexed Universal Life is a Better Choice

Historically, financial advisors promoted buy term and invest the difference because whole life insurance was too expensive. But this indexed universal life policy offers the same investment principle while keeping coverage for life.

By locking in a lower rate while young:

- You avoid high renewal costs later.

- You keep your age-based premiums and insurability locked in.

- Your coverage never expires as long as the policy is funded.

Additional Benefit: Chronic Illness Coverage

This policy also includes a chronic illness rider at no extra cost. If you become chronically ill and unable to perform two of six daily living activities for 90 days, you can access up to 80% of the death benefit tax-free for:

- Home health care

- Nursing home expenses

- Other medical needs

This built-in feature eliminates the need for a separate long-term care policy.

In the past, you had to buy a separate long-term care policy for this kind of protection. But with IUL, it’s included automatically, giving you security at every stage of life.

Final Thoughts

In summary, an indexed universal life policy provides:

- Affordable premiums

- Lifetime coverage

- Cash value accumulation

- Tax-free withdrawals

- Chronic illness protection

I hope this breakdown helps you understand why this is such a valuable financial tool.

If you’re thinking about getting life insurance, now is the best time to start.

Your

age and health determine your rate, so

locking it in early makes all the difference.

At Biaggi Life, we make sure your life insurance truly works for you.

With decades of experience, I’ll help you secure the right coverage.

If you want an expert to review your policy and protect your best interests, book a virtual meeting today.