Is Your IUL Up to Date? Part 2

Is Your Indexed Universal Life Policy Ready for Retirement?

Indexed Universal Life (IUL) policies are a flexible tool for financial planning, but older ones may lack the features needed for today’s financial goals. Reviewing and optimizing these policies is especially important for individuals approaching retirement or considering ways to maximize their policy's value.

This blog explores a real-life scenario involving a 15-year-old IUL policy with $270,000 in cash value and a $589,000 death benefit. It focuses on how the policyholder can leverage these funds for retirement income or other needs.

This case study was shared during a discussion between Frank Biaggi, CEO of Biaggi Life, and Kimberly Tran.

Watch the full conversation on the Let's Talk Life YouTube channel:

Using an IUL for Retirement Income

While IUL policies can offer options for retirement, older policies often have limitations.

In this scenario, the policyholder has $270,000 in cash value. However, the policy isn’t overfunded, meaning the cash value is just enough to sustain the policy without additional contributions. While the funds are there, withdrawing them risks reducing the death benefit or even causing the policy to lapse.

For individuals looking to use their IUL for retirement, this poses a challenge. Without sufficient funding, the policyholder can’t reliably withdraw money for income while maintaining the policy. In such cases, exploring alternative financial products can be more beneficial.

When an IUL doesn’t have the flexibility to support withdrawals, a 1035 Exchange can help transfer the funds into a more suitable product, like an annuity.

How an Annuity Can Boost Retirement Income

An annuity is an excellent option for turning an IUL’s cash value into guaranteed retirement income.

A 1035 Exchange allows the policyholder to transfer the $270,000 cash value into an annuity. This transfer preserves the tax-deferred status of the funds, meaning the policyholder won’t owe taxes on the earned interest during the transfer.

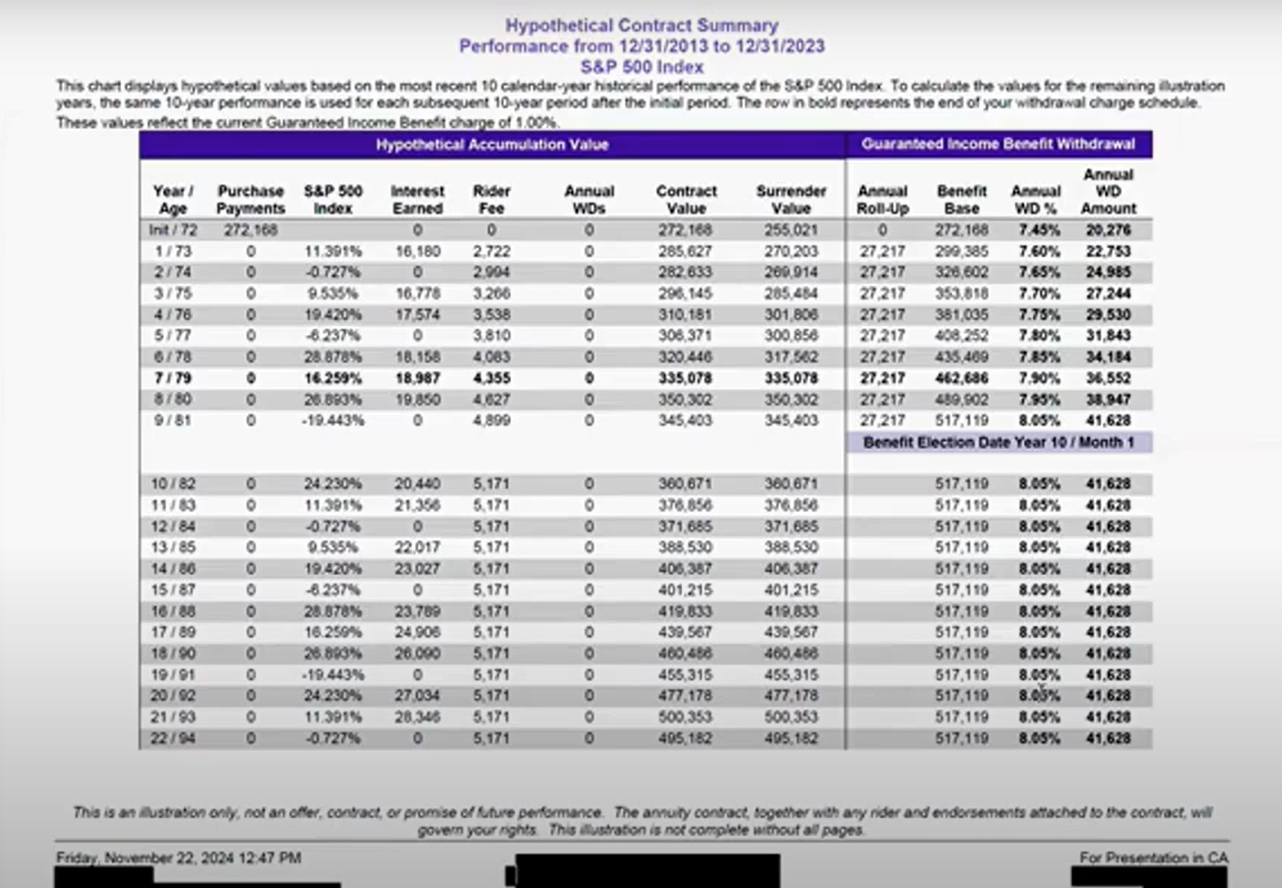

One recommended annuity offers a $27,000 annual bonus for 10 years, building a benefit base of $517,000. After this period, the policyholder can receive a lifetime income stream of $41,600 per year. This income is guaranteed for life, no matter how long the individual lives, even beyond 100 years.

This setup transforms the IUL’s cash value into a reliable, predictable source of retirement income, ensuring long-term financial security.

See photo below for illustration, and for further discussion, watch this video through this link.

Benefits of Annuities Over Life Insurance

Annuities provide unique advantages, especially for those seeking retirement income.

- No Medical Qualification:

Unlike life insurance, annuities don’t require medical underwriting. This is ideal for individuals with health issues who may not qualify for a new life insurance policy. - Steady Income:

Annuities create lifetime income streams. This ensures retirees have consistent cash flow for essential expenses, regardless of how long they live. - Tax Treatment:

While withdrawals from annuities are taxed as income, annuitizing the funds provides tax advantages. The income stream is treated as part principal and part interest, so only a portion is taxable.

These features make annuities a flexible and reliable solution for policyholders who want to turn their IUL cash value into a dependable source of retirement income.

Can Annuities Cover Nursing Home Costs?

Many annuities include nursing home riders, adding an extra layer of financial security.

In this case, the recommended annuity waives surrender charges if the policyholder spends 30 days in a nursing home or hospital. This ensures funds are accessible for long-term care expenses without penalties.

Additionally, annuities can provide leverage during nursing home negotiations. By choosing a lifetime income stream instead of keeping the full cash value accessible, the policyholder limits visible assets. This ensures nursing homes focus on the income stream rather than demanding large lump-sum payments.

This approach protects the policyholder’s remaining assets while ensuring access to care. It also helps keep funds intact for retirement and other needs.

Importance of Annual Policy Reviews

Regular reviews of life insurance policies are essential for ensuring they remain competitive and meet current financial needs.

Older policies often lack features like chronic illness riders or aren’t structured to maximize cash value. A review can highlight these gaps and present opportunities for improvement.

For example, newer financial products, like modern annuities or updated life insurance plans, often offer better benefits and lower costs. By exploring these options, policyholders can ensure their plans align with their financial goals.

Performing annual reviews with an experienced professional is critical. Professionals can assess whether the current policy is meeting the policyholder’s needs and recommend updates or adjustments where necessary.

As financial products evolve, reviewing an older IUL policy could uncover significant opportunities for better coverage and greater financial flexibility.

Conclusion

Maximizing the value of an old IUL policy is easier than many realize.

Whether the goal is steady retirement income, long-term care coverage, or enhanced cash value, solutions like annuities or updated policies can provide substantial benefits.

Taking the time to review and adjust a policy ensures better financial security now and in the future.

Why Choose Biaggi Life

Biaggi Life offers straightforward, expert guidance tailored to your needs. With Frank Biaggi’s extensive experience, policyholders get honest advice and customized solutions. Whether it’s optimizing an old policy or planning for the future, Biaggi Life delivers the knowledge and support needed to make the best financial decisions.