Why You Should Review Your Life Insurance Policy – A Case Study Part 2

How Can Life Insurance Policy Reviews

Help You? Part 2

I recently reviewed a life insurance policy for a 72-year-old client.

What I found shocked me—her expected $79,000 in cash value was actually zero unless she surrendered her policy.

Let me explain why reviewing your policy regularly is critical.

This blog is the written version of a YouTube video by Frank Biaggi, CEO of Biaggi Life.

Hi, I’m Frank Biaggi, CEO of Biaggi Life.

And today, I want to talk about why reviewing your life insurance policy is crucial.

I’ll share a real case study about a client I worked with that highlights the risks of not reviewing your policy.

The Client’s Case

I worked with a 72-year-old woman who had multiple life insurance policies—some I had written for her 20–25 years ago, while others were set up by a different agent.

As I reviewed the policies I had set up, her husband asked me to look at the ones from the other agent.

One of these policies immediately caught my attention.

It was a $400,000 life insurance policy with an annual premium of $7,000.

At first glance, it seemed decent—one column showed a cash value of $79,000 in 10 years.

But when I looked closer, something didn’t add up.

A Shocking Discovery

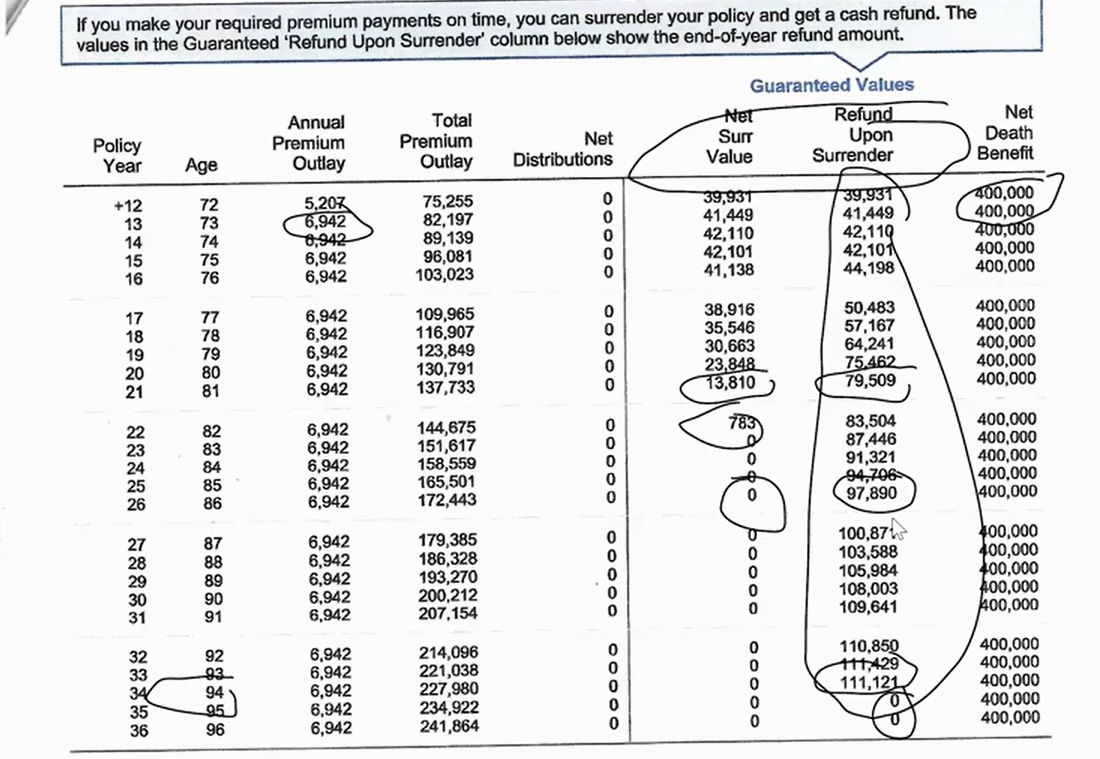

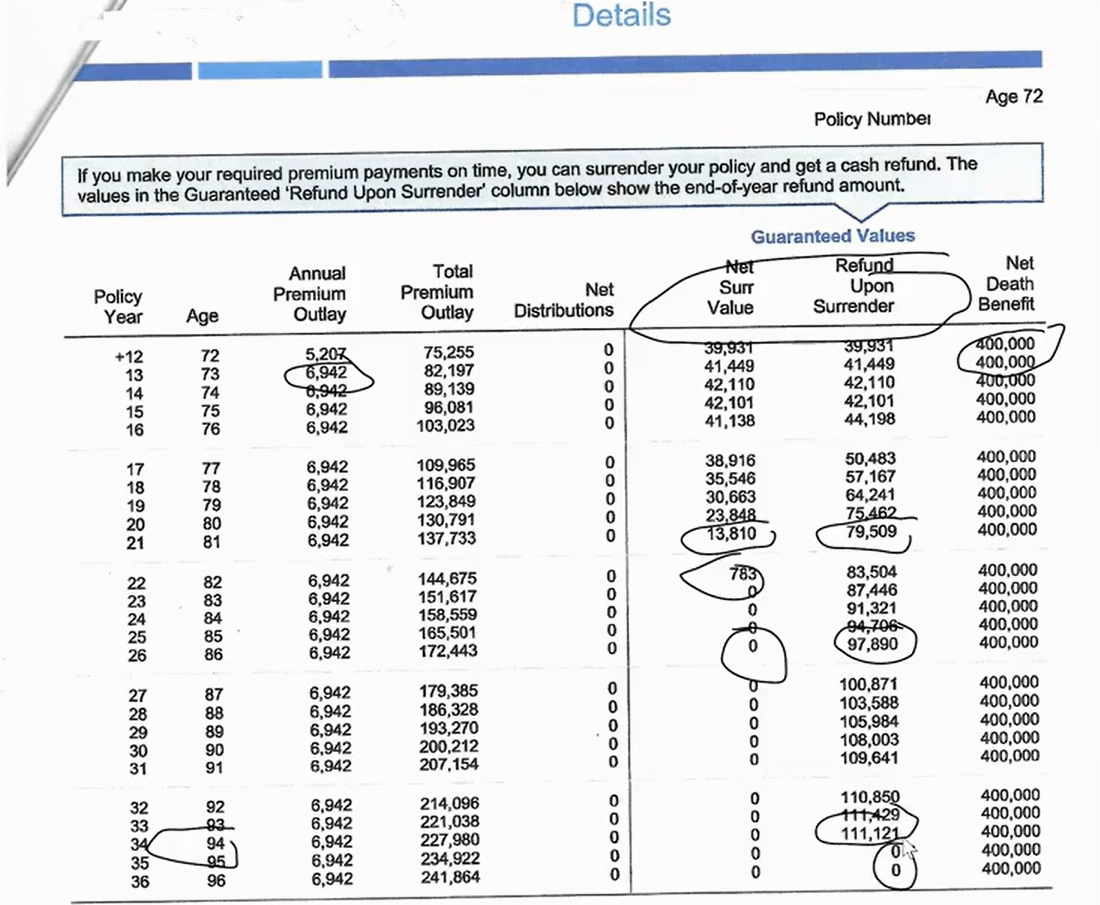

As I examined the policy, I noticed something odd.

The cash value increased for several years, but when the policyholder turned 94, the cash value suddenly dropped to zero.

That didn’t make sense. Typically, a policy’s cash value decreases gradually over time.

But in this case, the value just disappeared overnight.

To compare, I looked at another policy, which showed a cash value of about $85,000 at age 92 before slowly decreasing.

That was normal.

But this client’s policy completely zeroed out, which I had never seen before—even after decades of reviewing thousands of policies.

What Was Really Happening?

After analyzing the policy illustration, I discovered the issue:

The $79,000 shown in the policy was NOT actual cash value.

Instead, it was labeled “refund upon surrender.”

That meant the only way to access that money was to cancel the policy entirely.

In a real cash value policy, the policyholder can withdraw or borrow against the money while keeping the policy intact.

But in this case, my client would have to surrender the policy to get that money—losing her

$400,000 death benefit

in the process.

Even worse, the actual cash value in 10 years was only

$13,000—and within two more years, it would drop to

zero.

That meant all of her savings would disappear.

She had believed she had nearly $80,000 available, but in reality, she would have nothing.

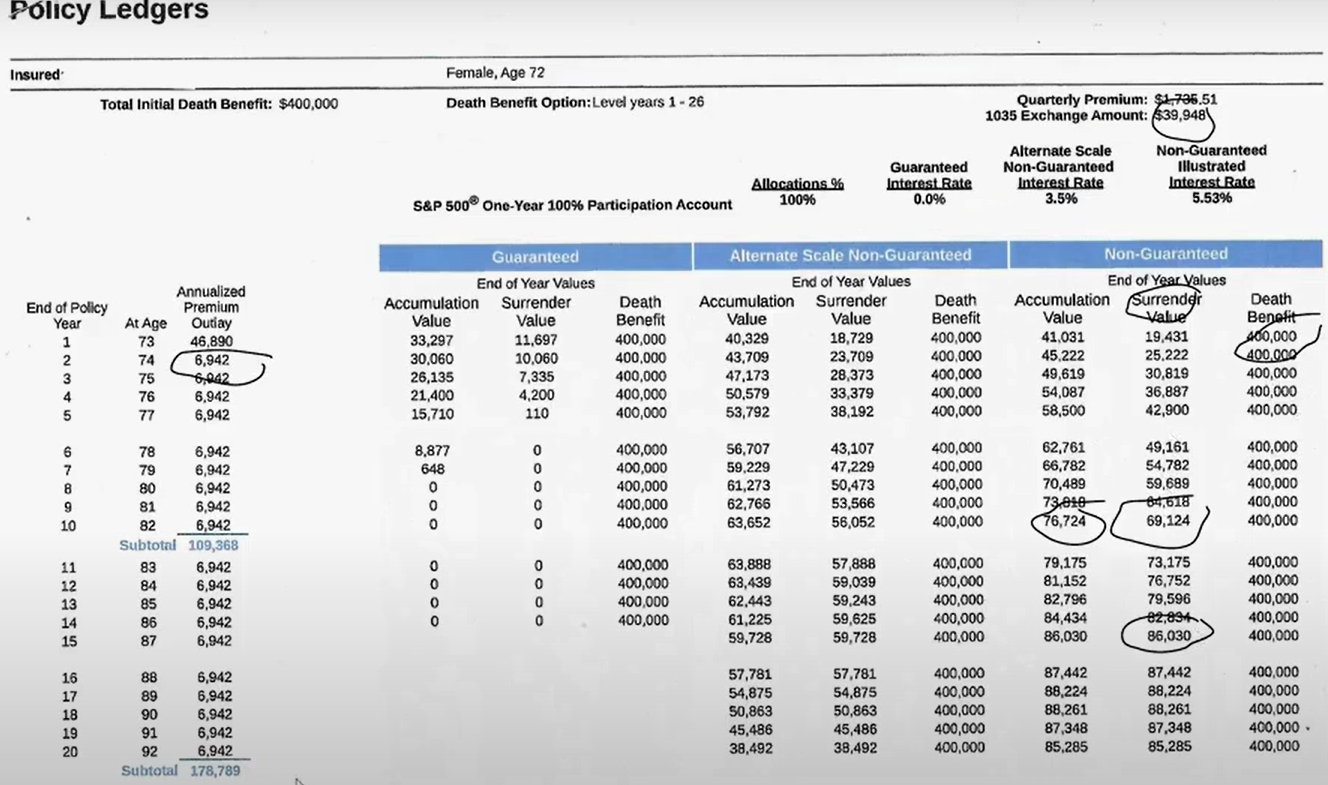

How We Fixed the Problem

Fortunately, my client was still healthy and had already qualified for new coverage.

To protect her savings, we used a 1035 exchange, which allowed her to transfer her policy to one that actually protected her cash value.

With the new policy, she:

- Kept her $400,000 death benefit

- Had access to real cash value

- Received additional benefits, such as chronic and critical illness coverage for nursing home or home health care

- Did not require a permanent disability to qualify for long-term care benefits

This switch prevented her from losing all her cash value and ensured she had a much stronger policy.

What If She Hadn’t Qualified for a New Policy?

She was lucky to be in good health, but what if she hadn’t been?

- If she had been uninsurable, she would have had no choice but to keep the bad policy and lose access to her cash value.

- If she needed the money, she would have had to surrender her policy, losing her $400,000 death benefit.

- If she couldn’t afford the premiums, she would have lost the entire policy—meaning she’d paid into it for years, only to end up with nothing.

Many policyholders don’t realize how misleading some policies can be.

In this case, the cash value column looked like an accumulation value, when in reality, it was just a refund if the policyholder surrendered the coverage.

That’s how class action lawsuits happen.

The Lesson: Always Review Your Life Insurance Policy

Had my client not reviewed her policy, she would have lost everything—her $90,000 expected cash value, her ability to pay premiums, and eventually, her entire life insurance coverage.

The best way to avoid this?

- Review your policy every year. Annual reviews help catch hidden issues.

- Work with an experienced agent. Someone who understands policies can protect you from bad deals.

- Ask questions. Don't assume the numbers on your policy mean what you think they do.

At Biaggi Life, we make sure your life insurance truly works for you. If you want an expert to review your policy and protect your best interests, book a virtual meeting today.

With decades of experience, I’ll help you secure the right coverage.

It’s always great to share these case studies with you—I hope this helps, and I look forward to next time!